Welcome To Episode 44!

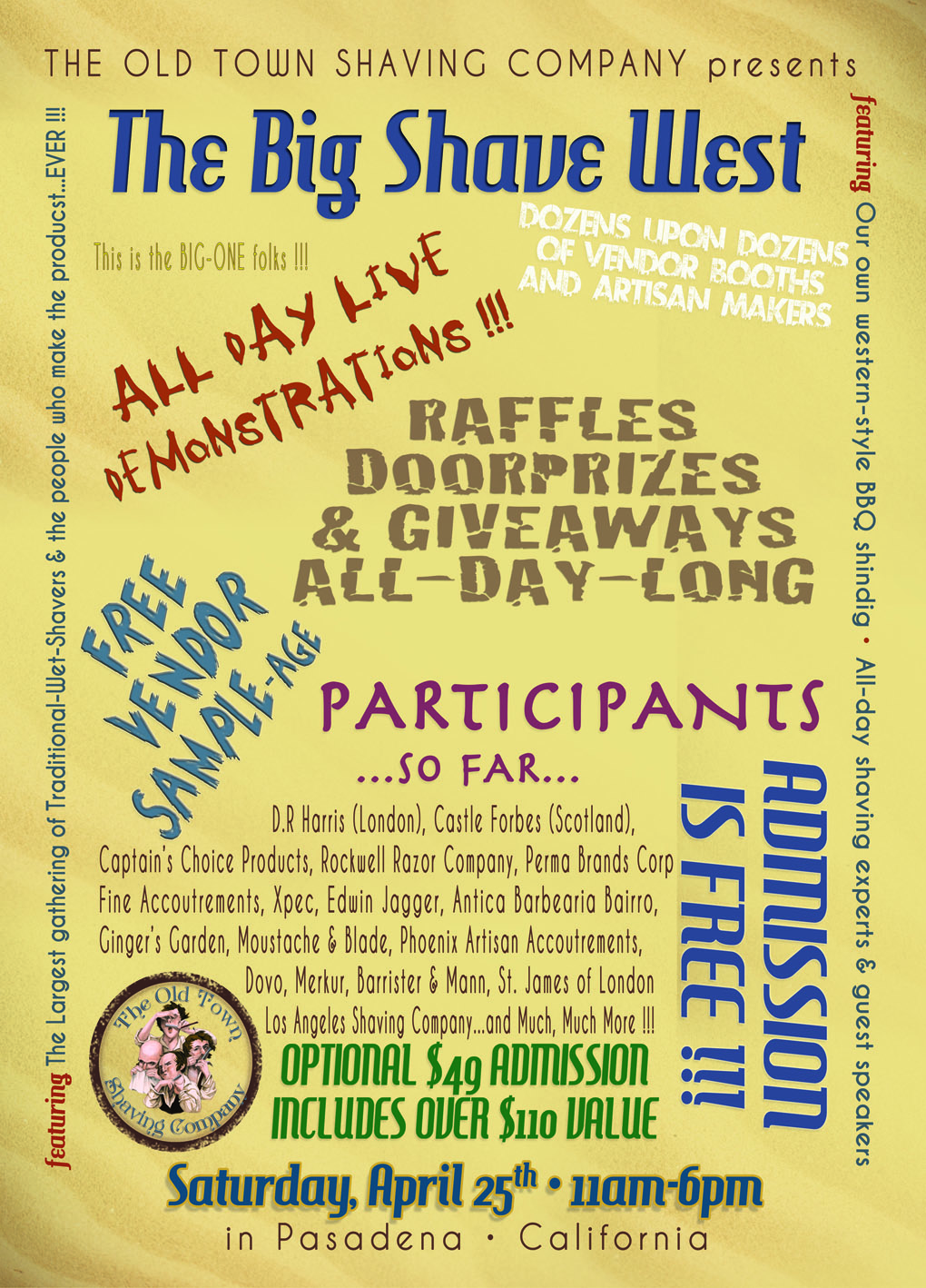

[Note: The Big Shave West Contest Is Below!]

What a great episode we have in store for you today folks! This one clocks in a little over 90 minutes and really packs in loads of tips, tricks and insight into the rabbit hole that wet shaving is. First off Ryan and Doug catch up on what’s new and prepare themselves, mentally and physically, for The Big Shave West Wet Shave West Gathering, happening in Pasadena, Ca this April 25th!

The Boys also catch up Jerry Rosenthal, founder and organizer of the Ohio Razor Meet-Up! This coming October marks their 12th Annual Event and Doug is excited to hear all about it. Special Guest Speakers, Like Minded Collectors and of course the mother load of vintage razors to be bought, sold, traded, shared and talked about! A really wonderful time for the budding razor collector or salted sailor…but don’t take our word for it, here’s a blurb from the official website:

The 12th National Shaving Collectibles Meeting is being held on October 10-11 of this year in conjunction with the National Shaving Mug Collectors Association. Collectors and fans of shaving memorabilia will gather with people having similar interests in safety razors, straight razors, shaving mugs, stroppers and hones, razor blades, blade banks, barber bottles, and other shaving related items. See in person those rare collectibles you only read about or see in pictures. Join your fellow collectors in an atmosphere of congeniality, sharing, and stimulating discussions and presentations.

A Special Thanks To Jerry for hanging out with us and giving us the skinny on what sounds to be one of the most unique meet-ups happening this season!

Happy Tax Day People! Normally that kinda greeting may seem out of place on a wet shaving podcast, but not today. We thought we’d try shave something off the top for our faithful listeners who happen to Buy, Sell, Trade, make Youtube Vids, Wet Shaving Podcasts, etc and pretty much wanna get some deductions for their hobby expenses. I know, sounds crazy but Douglas thinks he’s cracked the Collectors Code and dragged in his favorite wet shaving CPA, Mike Buckwash. Is Doug’s zany idea nothing more than a dream? Listen and hear as Mike lays down the facts and drops some tax breaking knowledge!

Here’s what it looks like on paper…digital paper:

1) A hobbyist, in the eyes of the IRS, can deduct hobby-related expenses only from hobby-related income. Read differently, hobbyists can deduct their hobby-related expenses only from the income our wonderful hobby generates. Okay, so stop and think about this for a second. Income means you made money on this hobby somehow. Expenses means you paid for something related to the hobby. Inherently, this implies that you cannot deduct hobby-related expenses if you don’t have hobby-related income. So, off the bat, someone who doesn’t want or doesn’t typically sell stuff on Buy/Sell/Trade’s (“BSTs”) , forums, eBay, etc…you can go grab a beer or something because this tax deduction conversation probably won’t interest you and you’re stuck with the expenses of the wet shaving world. J

2) These hobby expenses are deductible and included only as something called a “Miscellaneous Itemized Deduction”, which is a section of a Schedule you file with the IRS if you itemize your deductions. Now, this will also cross a lot of people off the list too of “those who care about this portion of the podcast”, as most of us just use the “standard deduction.” But, those of us with a home and paying a mortgage for example, typically itemize deductions and will still think this is valuable advice. What expenses are in a mortgage? Read this article to find out.

3) Don’t get greedy – you can’t say, “Well, in 2014 I bought a ton of wet shaving products and sold nothing…but in 2015 I plan on selling a ton so I can go back and get some of my 2014 expenses back.” That doesn’t work like that. There is no “hobby expense carryover” from year-to-year. Either deduct them in the same year you had the income, or lose the chance at the deduction forever.

Things to be careful for:

1) So, the IRS is kind of strict about what you consider a hobby and what is actually a business, with some vague and rather generalized guidelines…if that makes any sense. There are certain things that may force the IRS to consider you a business versus a hobbyist and tax you differently. Some of these things include but are not limited to: the amount of time and energy you put into this activity, the amount of success you have in the business, the appreciation of value of the assets in your activity, the amount of profits you make (pffft, who would have thought the IRS would care how much money you make from a hobby!), the expertise of you and your financial adviser, and others. So, take this all with an open mindset: if you’re a huge online retailer, you’re a business. If you’re a chum like myself with a few BST sales on forums or eBay…you’re in the right conversation and should be listening.

2) You simply HAVE TO keep detailed records. This would include keeping copies of receipts, copies of sales documents or transactions, documenting all cash coming in, documenting all cash going out, etc. Just anything you can think of that would appropriately appease the IRS in the case of an audit would work. We invest in good accounting and auditing services to take care of this for us. This is insanely important because it would prove to the IRS in the case of an audit that you aren’t making things up.

3) As I sit here typing this, my wife is laughing yet screaming at me that wet shaving will very quickly become a business to some…buying and selling and transacting solely to make money instead of doing it for what you love and why you love it. So, it’s important to say that, don’t let taxes destroy the hobby for you what you love!

Who should be listening to this? A Decision Tree…of sorts:

1) Do you sell wet shaving products? If yes, you have wet shaving income, and as all of us law-abiding citizens know, income from any source derived, unless otherwise stated by the IRS Code, is taxable. Therefore, you should listen to this and keep going down the decision-tree. If no, you have no hobby-related income, and you can probably stop reading/listening.

2) Do you file taxes? If yes, keep reading. If no, stop here.

3) If you file your taxes (as you should), do you use the standard deduction or the itemized deduction? If itemized, keep reading. If you use the standard deduction, you can probably stop.

4) If you’ve made it all the way down here…you win! You sell wet shaving products in your wet shaving hobby and try to make a few bucks, you file your taxes and use the itemized deduction as your mechanism to employ deductions in to your legal tax strategy!! Congratulations, you MAY be on your way to a deduction! Yes, you may be, but everyone’s financial circumstance is different. So read on…

4) If you’ve made it all the way down here…you win! You sell wet shaving products in your wet shaving hobby and try to make a few bucks, you file your taxes and use the itemized deduction as your mechanism to employ deductions in to your legal tax strategy!! Congratulations, you MAY be on your way to a deduction! Yes, you may be, but everyone’s financial circumstance is different. So read on…

The real meat and potatoes of this conversation:

Now, this is for those of you who made it into the 4th bucket above. The hobby expenses that you’ve incurred in any calendar year can directly offset the hobby income you’ve earned and are going to pay tax on. But (and a huge BUT!), only to the extent that your expenses plus your other qualified miscellaneous itemized deductions (which include unreimbursed employee expenses such as job travel, as an example) exceed 2% of your adjusted gross income (“AGI”). To define AGI without getting too jargon-y, AGI is your gross income earned less certain payments called “adjustments” that you have had to pay throughout the year such as alimony, self-employment taxes, etc.

The best way to illustrate hobby expenses is through an example.

Example:

Let’s just say you are a chum wet shaver right out of college with a decent-paying job, trolling the forums now and then, and have a few Plisson Synthetics on your hands that didn’t quite meet your top 5 brush listings which we’ve all seen on YouTube. But, you know that the Plissons are actually quite popular nowadays and people are actually turning a nice profit on these because you just can’t find them anymore! So, you decide to try and make a few bucks and sell off a few. You end up making $500 in total all year long – not bad for ten fake-haired brushes without backbone! However, this was a big year for you and wet shaving; you spent $600 on shaving gear! Don’t laugh – we all know how quickly those purchases here and there can add up! Anyways, if I am a tax-paying individual and happen to itemize my deductions…I could throw this on my “Schedule A” in the Miscellaneous Itemized Deductions line and hope for a deduction. What do you mean “hope” for a deduction? Well, as we said above…it will depend on your individual circumstances and if your total Miscellaneous Itemized Deductions are greater than 2% of your AGI. To put it mathematically…

- Gross income from all sources including wet shaving sales income – $35,500 ($35,000 from your normal job and $500 from wet shaving)

- No adjustments (just included this for sake of the example)

- Miscellaneous Itemized Deductions:

o Wet shaving hobby expenses: $500 (**Note that you can ONLY deduct expenses, $600 in our example, up to the amount of income you’ve made, or $500. So since I made $500 in income, and I can only deduct, at most, as much as I made, I can deduct $500)

o As a CPA, we have a ton of unreimbursed employee expenses, such as job travel, dues, job education, etc…and all those other “miscellaneous itemized deductions” add up to another $600. I know, I know, it is typically a lot more than that…but this is just for the sake of example.

o Thus, my total miscellaneous itemized deduction is $1,100 ($500 from wet shaving and $600 from “other”.

Since my AGI is $35,500, and 2% of that is $710, I have to have more than $710 in miscellaneous itemized deductions to actually achieve a deduction and get money back. If I am under this 2% threshold, unfortunately you don’t qualify and better luck next year. Since I have more than $710, I can deduct the difference of $1,100 (the total Misc. Itemized Deduction above) less the $710 = or $390! Wow, that’s almost 22 tins of Phoenix 8 oz. soaps!! Just to give you a comparison, if wet shaving hobby income and expenses were simply not part of your life and out of this equation…your deduction would be $0 as you would have not exceeded the 2% threshold…so, you can thank yourself later for the hobby and the $390 that it provided!

Since my AGI is $35,500, and 2% of that is $710, I have to have more than $710 in miscellaneous itemized deductions to actually achieve a deduction and get money back. If I am under this 2% threshold, unfortunately you don’t qualify and better luck next year. Since I have more than $710, I can deduct the difference of $1,100 (the total Misc. Itemized Deduction above) less the $710 = or $390! Wow, that’s almost 22 tins of Phoenix 8 oz. soaps!! Just to give you a comparison, if wet shaving hobby income and expenses were simply not part of your life and out of this equation…your deduction would be $0 as you would have not exceeded the 2% threshold…so, you can thank yourself later for the hobby and the $390 that it provided!

I hope this was clear and kind of fun –it was for me! I have to say that it is somewhat of a small population of gents who would actually realize any benefit of doing this, as you have to 1) pay taxes 2) itemize your deductions and 3) meet the 2% test that we walked through; however, I have no idea what the financial make-up of the wet shaving community is – so this may help someone!

Disclaimer

Now, I hate to have to do this, but I must include in these show notes a disclaimer for myself, for any tax wrong doings that may go on outside of my control. So, that being said, I should say that listeners of the podcast shouldn’t just rely on me based on the limited information in the podcast. Each taxpaying wet shaver should research their own unique tax facts before taking on a tax plan that we’ve mentioned and we cannot be held responsible for any tax penalties or evasion or any wrongdoings of any kind.

How To Make Your Very Own DIY Shaving Brush Cleaner

What You Will Need:

Distilled Water- Rubbing Alcohol – Shampoo – Detergent – Liquid Spray on Leave in Conditioner – A Clean Mason Jar Measuring Spoons – Measuring Cup – Stirer

Lastly the…

Big Shave West & Moustache & Blade Contest

2 Lucky listeners have the opportunity to win the much pined for, limited edition, exclusive to attendees only…until now, Pasadena Barbershop Scent Aftershave & Shave Soap! To Enter: Simply copy and paste The Big Shave West Flyer below and paste it to your Facebook, Twitter, Instagram or Gplus pages (or all of them) and then shoot us a link! That simple. This will greatly aid us in getting the word out and at the same time supply to cool cats with some unique wet shaving swag-age! Thank you for participating!

2 Lucky listeners have the opportunity to win the much pined for, limited edition, exclusive to attendees only…until now, Pasadena Barbershop Scent Aftershave & Shave Soap! To Enter: Simply copy and paste The Big Shave West Flyer below and paste it to your Facebook, Twitter, Instagram or Gplus pages (or all of them) and then shoot us a link! That simple. This will greatly aid us in getting the word out and at the same time supply to cool cats with some unique wet shaving swag-age! Thank you for participating!

Upcoming Wet Shaving Events:

The Big Shave West – Pasadena, CA – April 25th- For More Info Visit The Big Shave West @ Old Town Shaving Co

The South Florida Wet Shavers Meet-up – Homestead, FL – May 30th – For More Info Visit TSFWSMU Page

Chicago Wet Shavers Meet-Up! – Chicago, Il – June 6th – For More Info Visit CWSMU Page (Ray Pope Will Be There!)

Ohio 12th Annual Razor Meet-Up – West Chester Township, OH -October 10th – For More Info Visit The Razor Meet-up Official Site

Thanks to all our listeners for the support, feedback and all around positive “vibes”! We do this show for you and with much love and drive to play forward the wet shaving renaissance we now find ourselves in! Please don’t be shy and contact us today with any ideas, topics or guests you would like to hear on our humble little podcast. Bravo to you all and SHAVE ON, on ,on,on!

Thanks to all our listeners for the support, feedback and all around positive “vibes”! We do this show for you and with much love and drive to play forward the wet shaving renaissance we now find ourselves in! Please don’t be shy and contact us today with any ideas, topics or guests you would like to hear on our humble little podcast. Bravo to you all and SHAVE ON, on ,on,on!

Have a question for us or suggestion give us a ring! (347) 333-1511 [outside of US dial oo1 first]

You can also contact us via email: Douglas@moustacheandblade.com or Ryan@moustacheandblade.com

Please Follow us on Twitter and Join The HTGAM G+ Community today!

Please Check Out The Phoenix Artisan Accoutrements!

– Shaving Soap, Brushes, Razors & More!-

We also encourage you to please help us get the buzz out and visit: http://moustacheandblade.com this will bring you to a pre-populated tweet that all you need to do is send! Thanks again for listening and check out our other episodes!